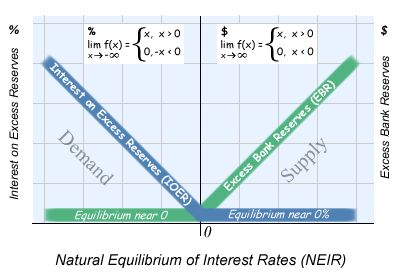

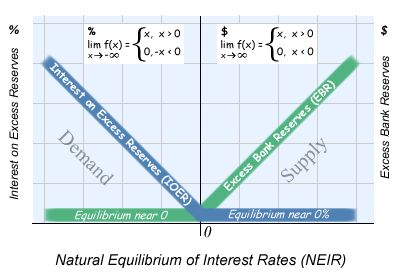

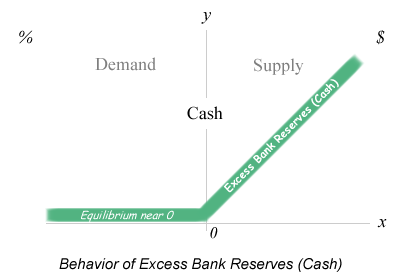

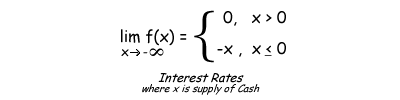

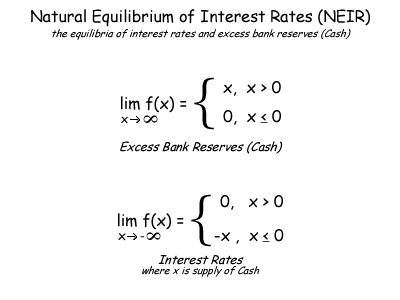

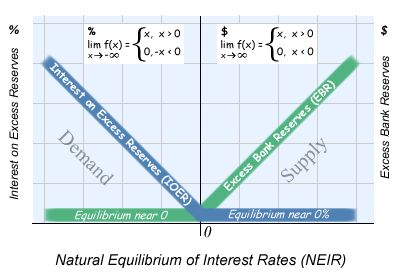

The Natural Equilibrium of Interest Rates (NEIR) is the combination of the equilibrium of excess bank reserves (EBR), and the equilibrium of interest on excess reserves (IOER), and both are affected by the supply and demand for reserves. The mathematics are observable and graphed on a 2D XY chart, where demand is the inverse of supply (-x), and the limit functions create an upside down cone with an apex at 0. When there is more demand than supply for reserves, excess reserves are in an equilibrium near 0 and IOER reflects demand. When there is more supply than demand for excess reserves, currently $1.7 trillion in the US, IOER is in a natural equilibrium near 0% without central bank intervention.

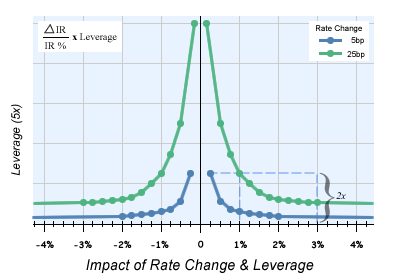

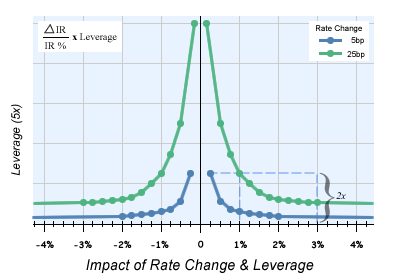

At near 0%, interest rates are stable near the apex, a near infinite amount of capital is available, any changes in interest rates have a non-linear impact,

and setting leverage rather than interest rates can be used to control money supply.

When there are excess bank reserves, any change in IOER by the central banks are deflationary for negative interest rates

and inflationary for positive interest rates.

There are two transitions in macro economics, see the matrix chart below. The first started in the mid '80s, when the US economy transitioned from an Isolated Domestic Economy to an Open Global Economy. The second started in 2008, when the US banking system transitioned from near zero excess bank reserves (EBR) to trillions of dollars globally. These transitions have created a "new" economy, where the near unlimited supply of workers and products due to globalization and technology keeps inflation low, while the interest on excess reserves (IOER) naturally moves to near 0%; stimulating demand and enabling governments, businesses and consumers to pay down debt. Any change in IOER by the central banks are deflationary for negative interest rates and inflationary for positive interest rates. Once there is more demand than supply of reserves interest rates and inflation will naturally rise.

Economics is ruled by the law of supply and demand. Inflation is caused when there is more demand than supply for products. The cost of capital is also determined by supply and demand, and is an integral part of inflation. By law, EBR can never go below 0, so in the banking system, banks with excess reserves are matched with banks that need reserves and the interest rate paid for reserves reflects demand. When there is more supply than demand for reserves, currently $1.7 trillion in the US, without central bank intervention, the over supply of reserves causes the overnight interest rate to naturally be near 0%. Inflation is kept low because the cost of capital is kept low and the near unlimited supply of workers and products.

After the financial crisis in 2008, the Federal Reserve used quantitative easing (QE) to add liquidity to protect against deflation while paying IOER to remove the excess reserves to control fed funds and to support 2% inflation. The result was a $4.5 trillion balance sheet and an interest cost of over $35 billion a year in IOER. It is fair to say, the founding bankers of the Federal Reserve Bank, Morgan, Rockefeller and Kuhn Loeb would never advise the Federal Reserve to pay interest on idle cash but rather emphasize the bank's business is to lend out their excess reserves. The founding bankers would remind the FOMC the Federal Reserve Bank was created to protect against financial crisis and advise the FOMC to reduce their balance sheet as soon as possible to prepare for the next crisis.

The quagmire for the Federal Reserve is their 2% inflation objective rather than keeping to Congress' "price stability" objective. If the Fed were not to pay IOER, fed funds and inflation would be near 0% as was the case in 2015. If the Fed were to change their 2% inflation objective to "price stability", the Fed could stop paying IOER and unwind its balance sheet to normalize rates and prepare for the next financial crisis fulfilling the objective of the Federal Reserve Act of 1913. This move would stimulate the economy while keeping inflation low and steepen the yield curve to support the US banking system, while helping return the current account balance back to equilibrium near 0, leveling the playing field for US workers and products. Any concern of an overheating sector can be better dealt with specifically by reducing permitted leverage rather than using the blunt tool of higher interest rates to slow down the economy.

In conclusion, while there are excess bank reserves, the economics of the Natural Equilibrium of Interest Rates (NEIR) causes IOER to be near zero.

The central banks can use QE to protect against deflation and reduce permitted leverage to protect against an overheating sector.

Once deflation is no longer a concern and to prepare for the next financial crisis, central banks can use quantitative tightening (QT) to reduce their balance sheet

with the yield curve anchored by overnight rates near 0%.

This enables the central banks to normalize their balance sheet without causing a taper tantrum while supporting their banking system with a steep yield curve.

Once there is more demand than supply for reserves interest rates and inflation will naturally rise.

|

TYPE OF ECONOMY | EXCESS BANK RESERVES | ||

| Transition started in the mid '80s | Transition started in 2008 | |||

| Isolated Domestic Economy | Open Global Economy | near 0 | greater than a few billion | |

| CONGRESSIONAL MANDATE | ||||

| Full Employment | There is a direct relationship between full employment and payroll inflation | Global competition keeps payroll inflation low while wages are determined by productivity | The increased cost of capital makes it more difficult to expand operations and invest in productivity | Full employment is sustainable as near unlimited reserves makes expansion more likely helping increase the employment participation rate and the use of artificial intelligence |

| Stable Prices | The limited supply of products puts upward pressure on prices | The near unlimited supply of products puts downward pressure on prices | The competition for reserves causes volatility from inflation to recession | Excess reserves creates stability with rates near the apex at 0% |

| MONETARY TOOLS | ||||

| Normalization | The lack of available capital puts upward pressure on interest rates | The near unlimited supply of capital puts downward pressure on interest rates | The interest rate paid for reserves reflects demand | The over supply of capital drives the interest rate paid to near 0% |

| Short Term Interest Rates |

Used to suppress demand to keep inflation low | The overcapacity of supply makes it no longer necessary to suppress demand | Banks compete for reserves and the interest rate paid reflects demand | Banks compete to lend out their excess reserves driving rates to near 0% |

| Repo Market | Used to manage demand for reserves to keep the economy from overheating or entering a recession | Global availability of reserves puts a downward pressure on rates | A small change in supply affects the interest rate paid for reserves | The Repo market is too small to affect a large amount of supply of excess reserves |

| Repurchase Agreement (Repo) |

Used to stimulate demand by lending reserves | The downward pressure on rates makes it less likely the Fed needs to lower rates further | The Fed buys collateral for a day essentially lowering interest rates | |

| Reverse Repurchase Agreement (Reverse Repo) |

Used to hinder demand by borrowing reserves | Less effective with all the global availability of reserves | The Fed sells collateral for a day essentially raising interest rates | |

| Interest on Excess Reserves (IOER) | Congress gave the Federal Reserve Bank the authority to pay IOER in October of 2008 | |||

| IOER | Excess reserves are inflationary in an isolated economy and need to be removed | Paying IOER suppresses demand while adding to capital inflation resulting in stagflation | There are no excess reserves to pay interest on | Paying IOER removes all the excess supply so the fed funds rate is anchored by the IOER rate |

| IOER and Inflation | Fed funds are naturally near 0% so an increase in the cost of capital is inflationary | |||

Contents

Introduction

Economics is the balance of supply and demand, its behavior is ruled by opportunity cost and the price reflects equilibrium or disequilibrium. The same is true for the capital markets and monetary policy, however the financial markets are not a zero-sum game so liquidity must be maintained since the last price paid determines value. The greatest liquidity exists at equilibrium, markets maintained at disequilibrium are only as strong as their manipulator. When there are excess bank reserves , the economics of the Natural Equilibrium of Interest Rates causes the "overnight" rate naturally be near 0%, any rate paid by the central bank above 0% is inflationary and any rate charged below 0% is deflationary.

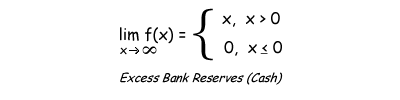

The model for the Natural Equilibrium of Interest Rates (NEIR) is simple and irrefutable. Applying the principle of Occam's Razor, NEIR is the preferred model because it does not rely on any assumptions or ad hoc hypotheses. Normally, there has always been more demand than supply for Cash so the economics and behavioral models have only been formulated for when Cash is near 0. The mathematical model for NEIR is the behavior of the opportunity cost for Cash. The model takes into account whether there is more supply or demand for Cash in the banking system which provides the model for the natural balance of interest rates on Cash. The model for NEIR is the combination of the behavior of interest rates for Cash and the behavior of supply for Cash. Typically, demand is greater than supply for Cash and by law can never go below 0, so Cash is flat in an equilibrium near 0 and overnight rates on Cash are greater than 0% reflecting demand. During these periods, central banks can easily affect interest rates on Cash by affecting the near 0 equilibrium on Cash in the overnight market by either buying or selling securities. Rarely, there is more Cash than demand, currently $1.7 trillion in the US, and because banks would not pay to lend Cash, interest rates on Cash are naturally flat in an equilibrium near 0% reflecting oversupply. When there is an oversupply of Cash, central banks can not easily affect the interest rates on Cash; though the natural overnight rate is near 0% many central banks have chosen to move the overnight rate lower through regulation or higher by paying interest on the excess Cash.

The Federal Reserve Bank removes the excess Cash in the banking system by paying interest on excess bank reserves (IOER rate) to keep fed funds and inflation expectations above 0% and to keep the economy from overheating. When there is excess Cash, slowing down the economy and adding to the cost of capital, the Federal Reserve is manufacturing stagflation. Prior to the Financial Crisis, both Asia and Europe were lending their current account surplus to the growing US current account deficit driving down the cost of capital. Chairman Bernanke recognized the global savings glut forming and advocated for the Financial Services Regulatory Relief Act of 2006 which would allow the Federal Reserve to pay interest on excess bank reserves to keep fed funds off of 0%. After the crisis, the Bank of Japan (BOJ), the European Central Bank (ECB) and many other foreign central banks chose to regulate negative interest rates for reserves in hopes of encouraging more lending and to weaken their currencies to maintain a current account surplus with the US. The negative interest rates unfortunately create deflation. If 2% inflation is the goal, foreign central banks need to return to 0% on Cash because negative interest rates are inherently deflationary and mathematically resemble a vertical asymptote as interest rates approach 0%. By letting overnight rates trade near 0% allows their currency to approach equilibrium to equalize the playing field for all workers. The same is true for the Federal Reserve which is raising the overnight rate for fear of inflation which has the effect of keeping the US dollar strong disadvantaging US workers while adding to the current account deficit keeping the US economy a debtor nation.

The excess supply of Cash in the US is due in part to the current account deficit with our trading partners which needs to return to equilibrium near 0. The current account surplus | deficit is mainly affected by two factors; economic productivity and currency value. Low interest rates enables investments in capital goods to increase US economic productivity while the multiplier effect generates consumer demand. At near 0% fed funds (US overnight rate), the US dollar can return to equilibrium helping the current account balance return to equilibrium near 0; leveling the playing field for US workers and products while reducing the global savings glut. The excess Cash in the US banking system is also due in part to liquidation of loans and investments and delayed purchases, essentially lack of demand. In an open economy globalization and technology creates structural deflation that needs strong demand to be kept at equilibrium. Reducing the Federal Reserve's balance sheet will help remove the excess Cash and once demand is greater than supply for Cash fed funds will naturally trade higher.

In an open economy when there is more Cash than demand, Cash chooses not to make purchases slowing down the velocity of money. In an open economy globalization and technology keeps inflation low with greater capacity and productivity. In an open economy any increases in wages is due to an increase in productivity rather than scarcity of labor. In the past, economic theory was only formulated for when there was more demand than supply for Cash, where the velocity of money was high. Many of these economic models are either 60 to 120 years old written about "closed" economies - essentially isolated domestic economies with limited capacity. These closed economies were less productive with less technological advancements so demand for products and full employment put upward pressure on inflation. In an "open" economy the increase capacity from globalization and technology keeps the price of products low and higher wages reflects an increase in productivity rather than an increase in production cost. The old economic models overemphasize the risk of inflation from full employment and do not take into account the structural deflation caused by increased global capacity.

An equilibrium is a stable state of being where the value can be definitely determined. It is a force of nature where the balance and behavior are determined by supply and demand and the advantage is that the equilibrium value can be known real time rather than estimated by a statistical model. NEIR can be directly observed in the overnight trading of Cash in the banking system. The natural equilibrium is the combination of the equilibrium of Cash and the equilibrium of interest rates on Cash. Both equilibria are affected by the supply and demand for Cash and only one can be at equilibrium either at near 0 or near 0%. The economic behavior for when there is more Cash than demand is far different than when there is more demand than Cash. The lack of demand and oversupply of Cash is from the liquidation of loans and investments. Rather than borrowing Cash to make investments and purchases, Cash sits idle waiting for opportunities slowing down the velocity of money. The over supply of Cash causes short term interest rates to naturally trade near 0% as banks try to lend out their excess Cash.

In conclusion, when there is more Cash than demand, the central banks should allow the equilibrium of interest rates on Cash to naturally be near 0%, use quantitative easing (QE) to protect against deflation; and once deflation is no longer a problem start quantitative tightening (QT) to reduce their balance sheet with the yield curve anchored by overnight rates near 0%. This enables the central banks to normalize their balance sheet without causing a taper tantrum and helps return the current account balance back to equilibrium near 0 leveling the playing field for workers and products. Once demand is greater than supply the interest rate on Cash will naturally rise.

⚬ Preface⇧

The Abstract is the economics of the Natural Equilibrium of Interest Rates (NEIR) and should be read with the accompanying graph to make it clear. The Introduction is meant to make the case for NEIR and encompasses the whole working paper but not in detail. This Overview is to give the reader a top down view of all the issues leaving the rest of the paper to go into the details. Use the table of Contents for navigation and to get a 30,000 foot view of everything. Though the mathematics were formulated in October 2016, please understand this working paper is a work in progress.

⚬ History⇧

⚬ Congress⇧

In 2006, Congress approved the Financial Services Regulatory Relief Act granting "Authorization for the Federal Reserve to Pay Interest on Reserves" providing a familiar tool for the FOMC to tighten interest rates when there is excess Cash. In 2008, the FOMC used this Act to pay interest on the excess Cash to keep fed funds above 0%, rather than recognize in an open economy the equilibrium lies in the current account deficit/surplus which can be affected by currency value and/or investments in capital goods. The near 0% interest rates enables the currency to reach an equilibrium leveling the playing field for workers and the near 0% rates enables investments in capital goods to make workers more productive. In sum, an open economy is deflationary and a savings glut occurs when capital forgoes purchases over lending and investing. What the central bank must do is stimulate demand for products and maintain an equilibrium with the current accounts with our trading partners.

⚬ Paradigm shift⇧

⚬ Ethical Policy⇧

⚬ Global Savings Glut ⇧

⚬ Monetary Models ⇧

Globally, the FOMC has responsibly led the way for monetary policy, however, the FOMC still relies on monetary models that are either 60 to 120 years old. The monetary policy to stimulate demand (D) to use up the excess Cash has never been formulated. During the Great Depression the demand came from WWII. In 1898, the idea of the "natural rate of interest" also known as R-star was introduced to help find the optimal short term interest rate to balance output with inflation. R-star suffers from being a theoretical value using inferred data and statistical analysis. The Phillips curve was introduced in 1958 to help find the optimal balance between employment and inflation. Both models were created using "closed" economies with limited capacity and employment, however, an "open" economy changes all that with unlimited capacity and employment. To be fair, when there is more demand than Cash, solving for D is challenging but when there is more Cash than demand solving for D is easy, it becomes the negative value of excess Cash and overnight rates naturally go flat near 0%, hence the Natural Equilibrium of Interest Rates.

⚬ Monetary Tools ⇧

⚬ Monetary Policy ⇧

After the global financial crisis in 2008, the central banks are dealing with the excess Cash subjectively by creating a narrative rather than objectively dealing with them in their disequilibrium. The central banks chose different strategies to remove the excess supply of bank reserves to give the markets time to recover and generate demand. The Bank of Japan and European Central Bank chose to charge interest on excess bank reserves causing negative interest rates. Both the BOJ and ECB hoped to encourage banks to lend out excess cash and lower the sovereign debt burden while their currency devalued and their current account surplus grew. In the US, the FOMC in the name of normalization after the passage of the "Financial Services Regulatory Relief Act of 2006", Sec. 201 "Authorization for the Federal Reserve to Pay Interest on Reserves"; currently pays over $25 billion a year in interest to depository institutions. The unintended consequences are it also slows down the US economy and encourages US banks to receive risk free interest from the Federal Reserve rather than lend out the cash to the private sector and buy US treasuries. Currently, by paying 1.25% on excess bank reserves causes the interest on the $20 trillion of national debt to be higher by over $200 billion a year over time. Every 0.25% rise in interest rates represents $50 billion a year in interest on the US national debt.

The mathematics of the Impact of Monetary Policy shows that both a move to negative interest rates or positive interest rates when excess bank reserves are in disequilibrium is deflationary. When the supply of excess bank reserves are greater than demand, the central banks should let the interest rate paid on cash naturally be 0%. While demand is less than supply for cash inflationary pressures are subdued and the cheap capital encourages demand. Once demand picks up again, excess banks reserves will return back to 0 which will cause interest rates to naturally rise.

⚬ Conclusion ⇧

In a global economy, full employment is no longer inflationary, as there is always someone willing to do the job cheaper but rather it is the demand for cash that affects interest rates and inflationary expectations. The challenge for monetary policy is fiscal policy has been running historic deficits to maintain entitlement programs without the adequate tax revenue to finance them. Monetary policy must find the path for the greatest economic growth with 2% inflation and moderate long-term interest rates. By letting the natural rate of interest be near 0% when excess bank reserves are in disequilibrium achieves these goals.

Commercial banks must maintain a minimum amount of bank reserves with their central bank equivalent to a specified percentage of their liabilities. Since each bank by law must have a certain amount of bank reserves, excess bank reserves can never go below 0. Between WWII and 2008, excess bank reserves were in equilibrium at 0, below $3 billion in the US, except during 9/11 when they reached $38 billion. Starting in September 2008, for the first time since the Great Depression, the supply of excess bank reserves were greater than demand. This disequilibrium is caused by capital moving from investments and loans into cash. By August 2014, excess bank reserves rose as high as $2.7 trillion in the US before leveling off as the US economy began to recover. The Federal Reserve Bank of St. Louis maintains transparent data as shown to the right.

Behavioral Models ⇧

Capital Markets are a force of nature and as such have natural equilibriums that can be observed in real time. An equilibrium is a natural calm state and for our purposes is found in the balance of supply and demand for capital. Modeling the behavior of cash, one-day capital is simple in that it can be graphed in 2D on a X Y chart using two sided limit functions, lim f(x){ to graph the behavior of the equilibrium.

⚬ Behavior of Excess Bank Reserves (Cash) ∞⇧

Around the globe, commercial banks must maintain a minimum amount of bank reserves with their central bank equivalent to a specified percentage of their liabilities. Since each bank by law must have a certain amount of bank reserves, excess bank reserves can never go below 0. If a bank needs reserves, it can borrow from a bank that has excess reserves and by the end of the day the objective is to have no excess reserves due to the opportunity cost of holding cash so all cash is put to work. While demand for cash is greater than supply, excess bank reserves are 0. When supply of cash is greater than demand, when excess bank reserves are greater than 0, the supply is simply positive. Typically, the excess supply is because of the demand destruction during a financial crisis, as was the case with the Great Depression and the Financial Crisis of 2008.

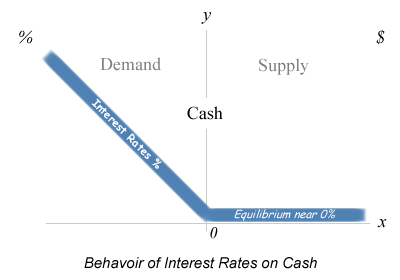

⚬ Behavior of Interest Rates on Cash ∞⇧

When supply is greater than demand for excess bank reserves commercial banks compete to lend out their excess cash and cause interest rates on cash to naturally be 0%.

Between 1942 - 2008, excess bank reserves have always been in a supply and demand equilibrium at 0 so the interest rate paid for cash

reflected the demand for cash and inflationary expectations.

The model of this behaviour is graphed on the right and the mathematics to graph it are are below:

⚬ Natural Equilibrium of Interest Rates ∞⇧

The Natural Equilibrium of Interest Rates can be directly observed in the overnight market,

as the interest rate paid for excess bank reserves (Cash).

Within this equilibrium of supply and demand, there are two outcomes which depend on the supply of excess bank reserves which are either 0 or greater than 0.

Typically, excess bank reserves are 0, when the demand for Cash is greater than supply and the interest rate paid reflects the demand for Cash and inflation expectations.

Currently and in the Great Depression, excess bank reserves are greater than 0, when the supply of Cash is greater than demand and

the interest rate paid is 0%, as commercial banks compete to lend out their excess reserves.

In the limit function for Interest Rates, x is the demand vs. supply of excess bank reserves and y is interest rates. The top half of the Interest Rates limit function, where supply is greater than demand for excess bank reserves is 0 because banks compete to lend out their excess reserves driving interest rates to 0% and banks would never pay interest to lend cash so interest rates would never go negative. This has been the experience since 2008, until the central banks artificially manipulated the interest rate on excess bank reserves where the Fed paid interest on reserves to raise rates and the BOJ and ECB charged interest on reserves to drive rates negative. In otherwords, without central bank manipulation interest rates on excess bank reserves would naturally be 0%. The bottom half of the Interest Rates limit function, experienced between 1941 and 2008, where demand is greater supply, so when x is negative f(x) multiplied by -x results in a positive y, where y is positive interest rates. Between 1941 and 2008, interest rates have always been positive when demand was greater than supply and excess bank reserves were 0.

The limit function for excess bank reserves is straightforward in that the outcome is a function of bank regulations where x represents demand vs. supply and y represents excess bank reserves. The top half of the limit function for excess bank reserves is when supply is greater than demand so when x > 0 f(x) = x, the quantity of excess supply of bank reserves. The bottom half of the function is by law kept at 0 because when demand is greater than supply, banks must borrow reserves to meet their minimum requirements causing excess bank reserves to never go negative. In fact, when you look at the actual graph of excess bank reserves since 1941, they have been at 0 until 2008.

⚬ Demand and Supply for Cash ⇧

Specifically, the demand and supply for cash affects the behaviour of excess bank reserves and interest rates. Generally, the equilibrium for cash affects the behaviour of micro and macro economics. This equilibrium is ruled by opportunity cost and as such is the binding force for the economy. Supply and demand is fundamental to the laws of economics and the equilibrium for cash is its foundation. The economy typically operates with excess demand for cash, except for those times after a financial crisis, where the economy suffers from demand destruction and there is an excess supply of cash.

Cash is a store of purchasing power. The behaviour of cash is ruled by the opportunity costs of being in cash, purchasing a product, making an investment or making a loan. These opportunity costs determine the equilibrium of supply and demand for cash. Typically, there is more demand for cash than supply, as all available capital is making purchases, making investments and making loans so the interest rate paid for cash reflects the demand for cash. However, when supply is greater than demand for cash, caused by lack of demand, causing the reduction in purchases, investments and loans, the interest rate paid for cash is 0%, as banks compete to lend out their excess cash.

There are many factors that affect the demand for cash beyond interest rates and quantitative monetary policy. There are the velocity of money, the elasticity of demand, regulations and taxes to name a few. But what is evident, is by observing the demand and supply for cash we can gain an insight into how much pricing pressure there is in the economy.

⚬ Inflation and Deflation ⇧

Inflation and deflation are ruled by the opportunity cost of purchasing now or later. The purchase price is ruled by the supply and demand for the product.

Prior to 1980, supply was a challenge as isolated domestic economies struggled to meet demand driving the price of products higher causing inflation. Currently in a global economy, the supply of a product is no longer a challenge, as nations compete for good jobs and technology adds to productivity. Rapid increases in technology will continue to put downward pressure on prices as productivity increases. This increase in productivity should be encouraged as workers finally become so productive they can be paid a good wage and the increased productivity keeps the cost of goods down. In sum, the supply of a product is abundant in a global economy.

In a global economy, it is demand that must meet supply. This demand can be directly observed in the supply of excess bank reserves. Typically, excess bank reserves are 0, so demand is greater than supply and this places upward pressure on inflation, as the pressure of opportunity cost is to purchase now. However, when supply is greater than demand and excess bank reserves are in a disequilibrium greater than 0 this places downward pressure on inflation, as the pressure of opportunity cost is to delay purchases.

In the decade that led to the Financial Crisis of 2008, much of the demand came from the purchasing power of wealth in real estate financed with Collateralized Debt Obligations (CDOs). Lack of regulation and oversight allowed "bad actors" to game the system and create an asset bubble.

⚬ Demand greater than Supply causes Inflation ⇧

Usually excess bank reserves are in equilibrium at 0 which means there is no extra cash. The demand for cash puts upward pressure on interest rates as consumers compete to make purchases, investments and loans. Prior to 1980, isolated domestic economies struggled to meet demand which drove inflation higher and created boom and bust cycles for the economy. After 1980, when globalization began to take hold, inflationary pressures lessened as global economies competed to meet demand.

The interest rate paid for cash reflects the demand for cash and inflationary expectations. This natural equilibrium keeps the economy in balance because as demand increases the interest rate to borrow cash increases hindering demand. Further demand destruction comes from monetary policy tightening, more stringent regulations and higher taxes.

⚬ Supply greater than Deflation causes Deflation ⇧

During those rare times when the supply of cash is greater than demand, due to demand destruction after a financial crisis. Monetary policy must allow the interest rates on cash to trade naturally at 0% and use quantitative easing to protect against further demand destruction. Restrictive regulations need to be removed and tax policy needs to be less burdensome.

⚬ Currency⇧

If currencies are properly priced there is no need for tariffs.

The challenge in the past was individual central banks had different "overnight" rates that affected the currency price and ultimately the equilibrium price. Currently, the central banks have pursued their own policy rather than allowing the "overnight" rate to be near 0% while there is excess Cash.

When there is excess Cash the natural overnight rate is near 0% and at near 0% there is no advantage / disadvantage placed upon the currency by the central bank. Globally when all overnight rates are near 0% all currencies can trade at their equilibrium price. Once the currencies are at equilibrium this levels the playing field for all workers. Once the currencies are equalized what will determined value will be national productivity. In this near 0% interest rate environment nations can invest in infrastructure to make their citizens more productive.

⚬ Productivity⇧

In this near 0% interest rate environment nations can invest in infrastructure to make their citizens more productive.

Congress⇧

⚬ Financial Services Regulatory Relief Act of 2006⇧

The law may have been written to be circular to give the Federal Reserve the authority to pay interest on excess bank reserves to allow short-term interest rates to be whatever the Fed chooses. However, the unintended consequences are it slows down the US economy and encourages US banks to receive risk free interest from the Federal Reserve Bank rather than lend out the Cash to the private sector and buy US treasuries. This law neutralizes the positive effects of quantitative easing (QE) on the US economy.

In sum, this law has been used by the Federal Reserve to neutralize excess Cash to control interest rates but the unintended consequence is it also neutralizes the effects of QE on the US economy. To better understand what is at stake politically and how Congress could change monetary policy, this paper shares hypothetical questions for the Senate Banking Committee.

⚬ Senate Banking Questions⇧

Senator:

The Authorization for the Federal Reserve to Pay Interest on Reserves was created for what purpose?

Senator:

The Act further states, "at a rate or rates not to exceed the general level of short-term interest rates."

Is it not true that if the Federal Reserve did not pay an interest rate on excess reserves (IOER), short-term interest rates would be 0%, as was the case after the financial crisis?

Chair:

It is true in the fed funds market short-term interest rates traded near 0% after the crisis but it was determined by the FOMC to keep rates at 0.25% to provide a monetary tool to lower rates,

if further easing was deemed necessary.

According to the Policy Normalization Principles and Plans adopted by the FOMC, during monetary policy normalization,

the Federal Reserve intends to move the federal funds rate into the target range set by the FOMC primarily by adjusting the IOER rate.

As indicated in the minutes of the March 2015 FOMC meeting, the Federal Reserve intends to set the IOER rate equal to the top of the target range

for the federal funds

rate.

If the Board's estimates of the natural rate of interest are imprecise and we observed the natural rate to be 0% when the Fed did not pay interest on excess reserves; why don't we just let the laws of supply and demand take over?

Chair:

The current consensus on the FOMC is the need for normalization. And though it is true short-term rates have been lower for longer than the Board has predicted,

there is consensus short-term interest rates will need to be raised further to keep the US economy from overheating.

Senator:

Overheating...there is approximately $1.7 trillion in excess reserves not because of excess supply but rather lack of demand. If that cash were put to work rather than receiving risk free interest from the Federal Reserve bank in the name of normalization; the US economy might have a better chance at 3 to 4% GDP growth.

Let's not kid ourselves, the US economy needs strong growth to support our $20 trillion national debt, every 1% increase represents $200 billion a year in interest.

Once demand picks up again and there is no excess cash, short-term interest rates will naturally rise. So I ask you, is the Federal Reserve bank paying interest "exceeding" the general level of short-term interest rates?

As for whether the Federal Reserve bank is paying interest "exceeding" the general level of short-term interest rates - that is something the Senate must decide. However, this tool is what we are most familiar with and without the ability to pay interest on excess reserves, this leaves the Federal Reserve bank without the monetary tools necessary to raise short-term interest rates, running the risk of inflation rising above 2%.

Senator:

I for one would rather see short-term rates naturally at 0% and have the Federal Reserve normalize its balance sheet,

knowing once demand picks up again, short-term interest rates will naturally rise.

Let's remember a reduced balance sheet keeps the Federal Reserve prepared for any future crisis.

I would like to see the US economy reach 3 to 4% growth, even if it means keeping the Federal Reserve from paying interest on excess reserves.

2% growth with 2% inflation does not better our way of life.

While we have this temporary phenomena of lack of demand, is it not beholden upon us to promote demand to put the economy back in equilibrium? During the same period in the Great Depression, demand did not increase until 1941 with WWII, and during that time inflation was negative and annual inflation never went over 3% in any one year. I believe everyone here wants good paying jobs for US workers and 3 to 4% growth helps us achieve these goals.

Wouldn't it be easier for the Fed to unwind its balance sheet with short-term interest rates naturally at 0%? It certainly would help the US Treasury finance the national debt.

Isn't it time we help main street, and stop rewarding the banks for not lending?

Monetary Models ⇧

Globally, the FOMC has responsibly led the way for monetary policy, however, the FOMC still relies on monetary models that are either 60 to 120 years old. The monetary policy to stimulate demand (D) to use up the excess Cash has never been formulated. During the Great Depression the demand came from WWII. In 1898, the idea of the "natural rate of interest" also known as R-star was introduced to help find the optimal short term interest rate to balance output with inflation. R-star suffers from being a theoretical value using inferred data and statistical analysis. The Phillips curve was introduced in 1958 to help find the optimal balance between employment and inflation. Both models were created using "closed" economies with limited capacity and employment, however, an "open" economy changes all that with unlimited capacity and employment. To be fair, when there is more demand than Cash, solving for D is challenging but when there is more Cash than demand solving for D is easy, it becomes the negative value of excess Cash and overnight rates naturally go flat near 0%, hence the Natural Equilibrium of Interest Rates.

⚬ Natural Rate of Interest (R-star)⇧

R-star is a theoretical number that might be precise for an individual price but loses its precision as it seeks the theoretical value for all prices. The imprecision also comes from using the Symmetric Properties of Equality to infer the observable data. For example, though it is true short-term interest rates affect output, that does not necessarily mean through the Symmetric Properties of Equality, output affects short term interest rates - and certainly not in an "open" economy. The imprecision also comes from the use of statistical analysis that relies on a normal distribution curve and as distribution moves away from normal the imprecision grows. When there is more Cash than demand overnight rates are flat near 0%, no longer declining, further distorting the distribution curve. Now that computers can observe a million times per second, the central banks can create the technological transparency needed to quantify demand (D) for cash in specific areas. This gives the central bank the precision to know where capital is demanded enabling either a micro adjustment through regulation to a specific area or a macro adjustment to overnight rates.