January 17, 2016

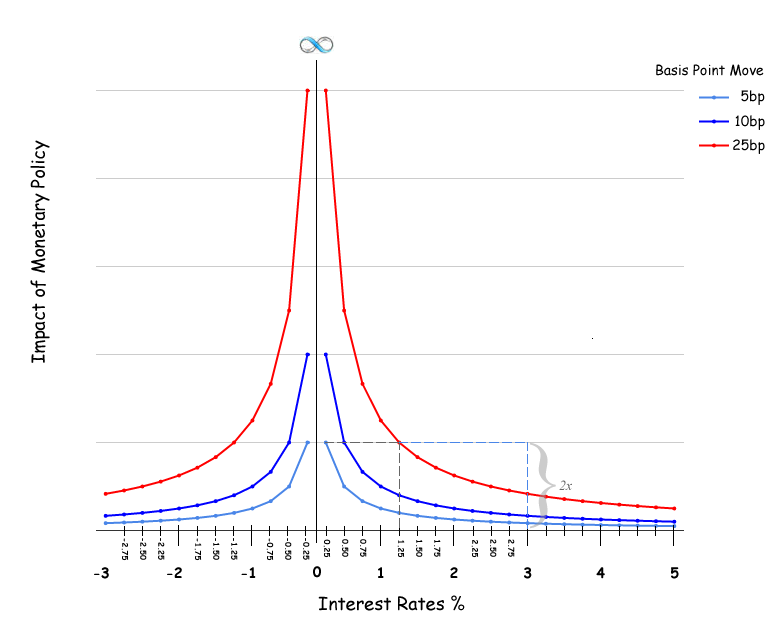

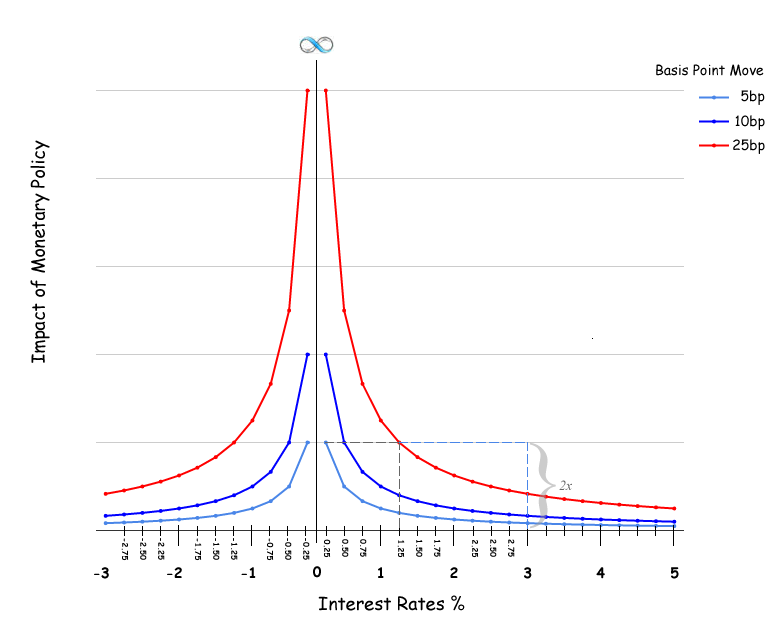

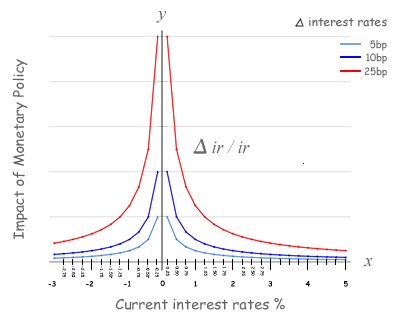

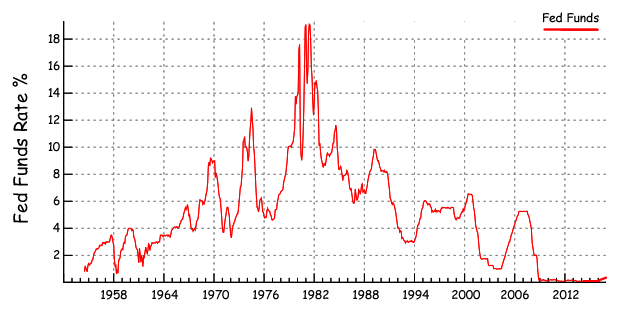

Over the past 60 years, the US Federal Reserve’s Fed Funds rate has spent most of the time above 3% (See chart below). The equation also demonstrates that when interest rates are 3% or greater, the impact of monetary policy looks linear. So previously, without empirical evidence, it is understandable why many view the impact of monetary policy as linear and believe more than one tightening is necessary for monetary policy to be impactful.

In 2008, in response to the global financial crisis, Federal Reserve Chairman Ben Bernanke lowered the Fed Funds rate to 0%. The Federal Reserve maintained the Fed Funds rate at 0% for over 7 years. The historically low level in the Fed Funds rate was meant to combat deflation while trying to achieve the Fed’s dual mandate of full employment and 2% inflation. During this time, US asset prices reached historic highs, inflation rose modestly (1-1.5%), while unemployment declined to 5%. Though inflation in the medium term had not reached the Fed’s mandate of 2% and the participation rate in employment had fallen, many in the banking industry called for the Fed to tighten in the name of “normalization.” The Federal Reserve in late December 2015 heeded the call for normalization and raised the Fed Funds rate by 25 basis points.

Since the Federal Reserve had never tightened when the Fed Funds rate was at 0%, and there was no empirical evidence to suggest otherwise, the Federal Reserve expected the impact of their monetary policy to be linear, much like the times when the Fed Funds rate was higher. The equation above demonstrates the Federal Reserve was right to expect the effects of monetary policy to be linear, but only if the Fed Funds rate was above 3%. By contrast, when the Fed Funds rate is near-zero, the impact of monetary policy is nonlinear and the effect of a 25 basis point tightening is quite substantial.

The empirical evidence demonstrates globalization is deflationary, even in the face of a weakening currency. The advanced economies in Asia, Europe and the Americas are faced with deflationary pressures and have governments with historically high debt. In short, the only stimulative capital available to these economies is from their central banks. Near-zero monetary policy provides the tools and the impact needed to stimulate these diverse economies while maintaining control over inflation.

Benefits of Near-Zero Monetary Policy

Near-Zero monetary policy is most effective against deflation at 0% because the availability of capital is near-infinite, as shown by the first graph.

By maintaining a near-zero monetary policy, the central bank provides the necessary stimulus for economic growth while creating the ideal scenario for the central bank, the treasury, investment capital and consumer credit.

Because the impact of monetary policy is nonlinear at near-zero, this enables the central bank to micro adjust the Fed Funds rate at near-zero and have an impact on inflation.

For a sovereign nation, the ideal situation is having a treasury operate without a deficit and funding infrastructure projects at near-zero interest rates.

To support an economy strong enough to generate tax revenue for the treasury to operate without a deficit,

investment capital at near-zero interest rates would be available to the private sector to generate growth.

And to support all this growth, consumer credit is available at near-zero interest rates to provide the consumer with the maximum purchasing power.

The intended consequence is a healthy consumer and strong economic growth, enabling the sovereign nation to pay off its debt and fund infrastructure projects,

while the central bank’s near-zero monetary policy achieves its goal of balancing full employment with 2% inflation.

Conclusion

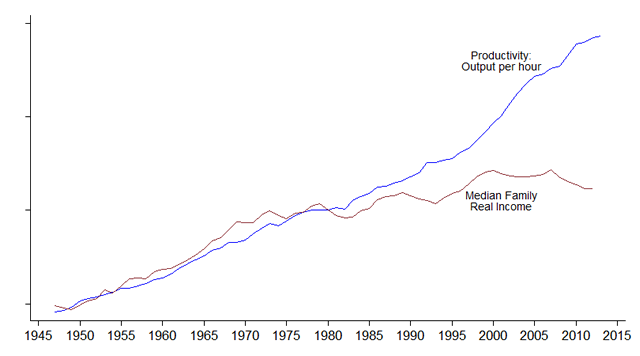

Diverse economies in the 21st century are faced with deflationary pressures due to increasing productivity and globalization.

Now that we have empirical evidence of the nonlinear impact of monetary policy and the equation to quantify it,

near-zero monetary policy becomes a powerful tool for the central banks to stimulate their economy while controlling inflation.

Near-zero monetary policy creates the ideal capitalistic environment, where the global economy operates with near infinite amount capital used to generate economic growth and prosperity.